Key Truths Insurers Need to Know About Litigation Finance - as Reported by the ABA/BNA

Insurance companies are actively examining the threats and opportunities that litigation finance poses for their business. They stand to gain by availing themselves of funding to bring cases where they have suffered an injustice. But, they have concerns about how access to funding could expose them to greater risk in suits brought by or against their insureds.

A panel at the 16th Annual Legal Malpractice and Risk Management Conference that addressed some of the key truths insurers need to understand about litigation finance has now become the featured topic in a recently published addition to the ABA/BNA Lawyers’ Manual on Professional Conduct, entitled Litigation Funding on the Rise in Big Civil Cases, Panel Says. Bentham IMF Investment Manager Jim Batson participated in the panel, along with Matthew Probolus, E&O Portfolio Manager at Travelers Bond & Specialty Insurance, and moderator J. Richard Supple, a partner at Hinshaw & Culbertson LLP.

While only about one-third of panel attendees reported involvement in a case where the plaintiff received litigation funding, other recent surveys referenced in the review indicate an upswing in financing for civil cases. The increasing popularity in using litigation finance as a means of bringing civil cases is being carefully tracked by insurers.

On the one hand, insurance companies, which tend to be risk-averse and cost-conscious, are likely to embrace opportunities to use litigation finance as a means of lessening their downside exposure as plaintiffs in litigation. They can use funding to hire top-tier counsel without assuming the burden of paying top-tier legal fees. Pointing to the common disconnect between a law firm’s willingness to take on risk in litigation versus the client’s appetite for risk, Batson explained that inquiries about litigation funding typically come from lawyers trying to structure an acceptable alternative fee arrangement for their clients. Funding also allows insurers to pursue claims without carrying the cost of litigation as a liability on their books, since such costs are not incurred unless and until the case reaches a successful conclusion. If the case is lost, the company pays nothing.

On the other hand, insurance companies realize that they are likely, at times, to find themselves defending against suits brought with funding. The panel addressed concerns that many insurers are confronting in anticipation of this trend, including the role that funders will take in a case, how funding could impact the amount insurers spend defending cases and whether it will make settlements harder to reach.

The degree to which funders exert control over litigation decisions was also discussed. Insurers, who enjoy certain privileges related to controlling the course of litigation and settlement decisions in cases brought against their insureds, stand in a very different position than litigation finance companies. Investing in the outcome of a litigation does not give funders a right to exert control over decisions made about litigation strategy or settlement offers. While funders like Bentham often contract to retain the right to be kept informed about major milestones and advised of decisions to change counsel in funded cases, Batson noted that the rights insurers retain to influence how cases are litigated are far greater.

Probolus indicated that insurers also have concerns about “potential for abuse” by litigation funders that could result in more frivolous cases and higher litigation costs. Insurers troubled by this possibility may take comfort in the fact that funders only profit from successful cases. At Bentham, we decline to fund ninety-five percent of cases presented to us. As Batson noted during the panel, “if I start funding frivolous cases, I’ll lose my job.”

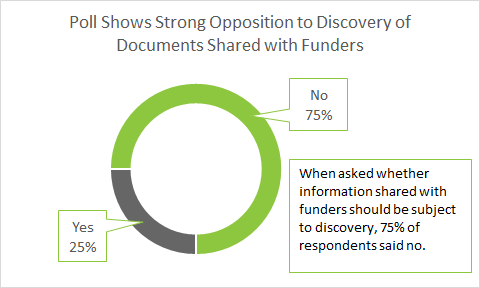

A second poll conducted during the program showed seventy-five percent of attendees in favor of plaintiffs disclosing when they have received funding, but only twenty-five percent indicating that the information shared with the funder should be subject to discovery. Probolus expressed the view that insurers want to “know who’s behind the curtain” because “the unknown for the insurance marketplace is a scary thing.”

Batson pointed out that defendants would have a tactical advantage in cases where plaintiffs weren’t being funded if disclosure of all litigation funding arrangements were mandated. Some plaintiffs enjoy being better-positioned in settlement negotiations when the opposing party knows they have funding. However, the choice to disclose how they are financing their suit should be left to each individual plaintiff.

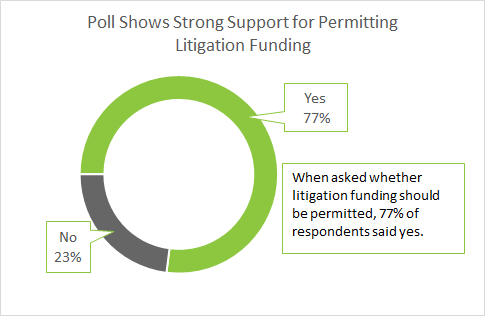

While these and other issues surrounding litigation finance will continue to be widely debated throughout the legal industry, the panel attendees were clear on one thing: seventy-seven percent said litigation funding should be permitted. Where insurance companies will come out on that question remains to be seen.

For a full summary of the issues addressed by the panel, read Litigation Funding on the Rise in Big Civil Cases, Panel Says.