Leaving Money on the Table? Why Private Equity Can't Ignore Dispute Finance

Legal disputes involving portfolio companies may be common in the lifecycle of a private equity transaction, yet they’re rarely treated as opportunities. Too often, they are kept separate from the value-creation plan, or avoided entirely, because of their perceived negative impact on valuations. But with the right tools, they can be used to create value at various stages of an investment. Dispute finance enables PE firms to accurately quantify legal disputes during acquisition through a probability-weighted risk-adjusted net present value (NPV) framework, creating negotiating leverage; preserve EBITDA, mitigate downside risk and monetise legal claims during the value creation period; and maximise enterprise value at exit by enhancing valuation metrics. This post explores how legal disputes can be a source of hidden value for PE firms when viewed through the right lens.

Acquisition

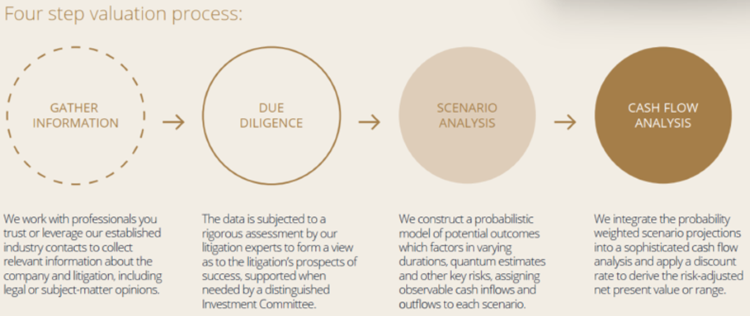

Diligence will expose whether a target company is involved in an actual or potential legal dispute, but it won't tell you what value can be extracted from it. Omni Bridgeway's specialist team can reduce legal disputes into a probability-weighted risk-adjusted NPV figure (or range), which can then be leveraged to create value. Below is an illustration of the process we adopt:

The probabilities and assumptions that underpin this analysis are drawn from decades of unparalleled global experience across a broad range of disputes, ensuring the ultimate figure reached is grounded in real-world outcomes. When it comes to negotiating the deal, knowing this figure can provide a strategic edge. For example, if the target company is a plaintiff in a legal dispute which has good prospects of success, the seller may try to factor the potential cash inflows into the sale. However, this ignores the fact that any legal dispute, even when prospects are seemingly good, is a risk-laden adventure which can result in multiple outcomes, including loss. By probability weighing the various potential outomes and adjusting the claim for risk, the estimated cash inflows become substantially less than the claimed amount. Further, once future cash outflows are factored in (e.g. legal fees), and discounts applied to all anticipated cashflows to reflect the time value of money and relevant cost of capital, the estimated cash inflows become lower still. Omni Bridgeway can produce a report detailing this analysis which can then be utilised in negotiations to avoid paying over the odds.

Example

A target company is a plaintiff in litigation with a claim size of $10 million which is estimated to complete in 3 years. It has received a legal opinion which indicates it has strong prospects of winning and is seeking to factor the anticipated future cash flows into its valuation. The PE firm wants to avoid paying over the odds and engages Omni Bridgeway to value the litigation and produce a report for use in negotiations.

Step 1: Determine the expected cash inflows

The claim might not result in a $10 million payment - there are multiple risks involved. Omni Bridgeway's litigation specialists undertake a comprehensive due diligence process which addresses all legal and financial aspects of the claim. The result is a probabilistic model of all potential outcomes, derived from the features of the case itself and statistical probabilities based on past resolutions of similar proceedings. After factoring in the various outcomes upon judgment, the chance of a compromised settlement and adjusting for loss risk, the risk-weighted expected cash inflow is $6 million.

Step 2: Determine the expected cash outflows

Costs to prosecute the litigation must be deducted from any value calculation. Based on the budget prepared by the lawyers, the legal team's fees, experts' fees and all other expenses necessary to prosecute the litigation are estimated to be $1.2 million spread over 3 years. Subtracting this from the risk-weighted expected cash inflow results in $4.8 million.

Step 3: Discount future cash flows to present value

Any payout won't happen today - it happens in 3 years. Since money today is worth more than money in the future, the future cash inflows and outflows need to be discounted to reflect their present value. Other considerations such as the cost of capital can also be factored into this calculation. Assuming a 10% discount rate, the present value of the $6 million cash inflow is approx. $4.5 million, and the present value of the $1.2 million cash outflow is $1 million.

Step 4: Calculate the probability-weighted risk-adjusted NPV

Understanding the probability-weighted risk-adjusted NPV of the litigation requires the discounted probabilistic cash outflows to be subtracted from the discounted probabilistic cash inflows. This results in a figure of $3.5 million.

Analysis

Having regard to the above analysis, if the PE firm were to pay anything more than $3.5 million for the litigation it would be overpaying for an uncertain future payout - i.e. paying for value that doesn't exist. Further, if the claim takes longer or fails, the PE firm will suffer even more, and the money could have been used elsewhere for better returns. Omni Bridgeway's report enables the PE firm to negotiate on the basis that the litigation is worth $3.5 million in today's terms, not $10 million - a $6.5 million improvement in position.

Value creation

PE investments are often highly levered, meaning every dollar tied up in litigation is a dollar unavailable for core operations, value-enhancing initiatives or debt repayment. Because working capital is critical in these environments, diverting it to fund legal disputes can constrain the business and directly impact earnings. Meritorious legal claims may also go unpursued due to concerns about the drag on EBITDA and the resulting impact on valuations. These issues are magnified in distressed investments, where limited liquidity and heightened creditor activity make legal costs especially burdensome. Dispute finance addresses these challenges by funding legal costs and giving portfolio companies the potential to receive a portion of their claim value before the case concludes. Further, in jurisdictions such as Australia, the risk of having to pay the other side’s legal costs in the event of a loss can be shifted to the funder. By partnering with Omni Bridgeway, PE firms can enhance a portfolio company’s financial metrics and eliminate the financial downside of pursuing legal claims. This ensures the company is never in a worse financial position than if it had not litigated, while gaining upside potential tied to a successful outcome.

Dispute finance can have a direct and positive impact on a portfolio company’s EBITDA. Ordinarily, legal fees reduce EBITDA due to their treatment as Selling, General & Administrative (SG&A) operating expenses. But when funded, these costs bypass the P&L entirely. Crucially, because dispute finance is non-recourse (i.e. there is no obligation to repay the funded amount if the case fails), there is no corresponding liability on the balance sheet. The following simplified example income statement shows how funding legal costs can preserve $2 million in EBITDA – pure upside from a valuation standpoint:

| Income Statement | Without Funding | With Funding | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | $50,000,000 | $50,000,000 | ||||||||||||

| Cost of Goods Sold | ($30,000,000) | ($30,000,000) | ||||||||||||

| Gross Profit | $20,000,000 | $20,000,000 | ||||||||||||

| SG&A Expenses | ||||||||||||||

|

||||||||||||||

| Total SG&A | ($9,000,000) | ($7,000,000) | ||||||||||||

| EBITDA | $11,000,000 | $13,000,000 | ||||||||||||

Further, portfolio companies can request a capital advance secured against the contingent proceeds of a legal claim on a non-recourse basis or sell that claim to a funder at a discounted price. By monetising legal claims in this way, PE firms can increase the capital available for value enhancing initiatives without deploying their own funds. This can result in higher IRRs and overall returns, achieved without increasing downside exposure.

Exit

Every element of a portfolio company's financial

performance influences its exit valuation. When utilised strategically, each of

the tools discussed in this post has the potential to increase enterprise value

and deliver greater returns to PE firms and their investors. For example, we explored

how Omni Bridgeway’s valuation framework can derive a

probability-weighted risk-adjusted NPV figure (or range), which can be used to

create negotiating leverage in an acquisition scenario. Inversely, the same

framework can be used in an exit scenario to ensure portfolio companies who are

defendants in legal disputes do not underprice their exit value due to the risk

of a negative outcome.

We also discussed how funding legal costs can preserve a company's EBITDA. As readers will know, an increase in EBITDA can directly increase valuation multiples. To illustrate this, let’s revisit the example income statement from the previous section and apply an 8x EV/EBITDA valuation multiple:

| Valuation Metric | Without Funding | With Funding |

|---|---|---|

| EBITDA | $11,000,000 | $13,000,000 |

| EV/EBITDA Multiple | 8x | 8x |

| Enterprise Value (EV) | $88,000,000 | $104,000,000 |

Based on this example, the same business - with no change to its operations or revenue - could be worth $16 million more purely due to the funded legal costs and resulting EBITDA uplift. While this is a simplified illustration, it highlights the conceptual upside. Although a detailed analysis of potential fund-level returns is beyond the scope of this post, readers will appreciate how an increase in enterprise value can translate to a higher MOIC and IRR on exit.

The Bottom Line

Dispute finance transforms portfolio companies' legal claims into strategic assets that PE firms can leverage at every stage of the investment lifecycle. It provides the tools to avoid overpaying at acquisition, preserve EBITDA and unlock capital during ownership, and achieve higher valuations at exit. By funding legal costs, monetising claims through non-recourse capital advances, and shifting risk to the funder, PE firms can capture upside without increasing downside exposure. The result is stronger portfolio metrics and higher IRRs - money that would otherwise be left on the table.

To explore how Omni Bridgeway can help deliver these outcomes for your portfolio, connect with us today.

Authors:

Chris Lisica

Joseph Schultheiss