What insolvency practitioners need to know about small claim and ‘seed’ funding

For more than 16 years IMF has funded insolvency and restructuring professionals (IPs) to pursue litigation with a view to increasing returns to creditors. The types of insolvency claims funded by IMF commonly include:

- breaches of directors’ general law and statutory duties

- transactions voidable in insolvency (eg preference payments; uncommercial transactions)

- insolvent trading

- claims against professional advisors and other third party defendants

IMF has provided funding for high-value, complex insolvency litigation: Babcock & Brown Australia Ltd, ABC Learning and the BBY group to name just a few. Such cases can have claim values ranging from tens to hundreds of millions of dollars and the litigation costs can run into many millions of dollars.

At the opposite end of the spectrum IMF provides funding for small corporate and personal insolvency claims. IMF has established a separate Australian Small Claims Committee (ASCC), which evaluates funding requests for claims where the estimated litigation budget is under $1 million. Claim value is typically $1 million or more however IMF also funds less valuable claims which otherwise satisfy the ASCC’s investment criteria.

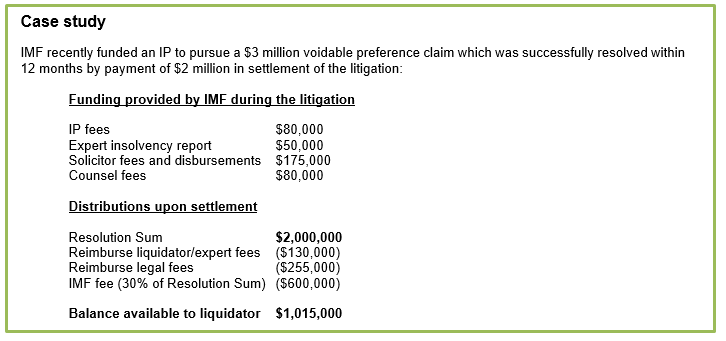

In the above example, IMF assumed the entire project risk by paying all costs incurred in conducting the litigation, including IP, solicitors, Counsel and expert fees as well as providing 100% adverse costs cover. After reimbursement of costs and payment of IMF’s fee, the IP received just over $1 million for distribution to creditors1.

Preliminary funding

IMF also offers preliminary or “seed” funding which enables an IP to obtain legal or expert advice or conduct public examinations to establish legal claims identified by the IP in the course of investigating the company’s affairs. Preliminary funding is usually between $20,000 and $50,000 (although it can be more) and is provided under a short Preliminary Funding Agreement (PFA). If IMF offers to fund the substantive claim following completion of the parties’ investigations, and the IP accepts IMF’s offer, the parties will enter into a Litigation Funding Agreement (LFA) which contains the terms upon which IMF agrees to fund the claim.

A question IPs have asked IMF is: how small is too small?

How small is too small for a litigation funder?

Claim value is unquestionably a key factor in the funding decision. A $1 million claim can be as complex and expensive to run as a $5 million claim. As claim value moves below $1 million it is likely to be less commercially viable to fund. An inflection point is reached where the costs and risks approach or exceed potential recoveries. In the insolvency context, Court approval, if required, may depend upon the IP demonstrating that pursuing the claim is in the creditors’ interests. To that end Courts have regard to claim value and likely return to creditors.

Nevertheless, IMF considers a number of criteria in determining whether to approve funding and claims valued less than $1 million are not necessarily rejected outright as ‘undersized’. Other aspects of the claim can swing the balance in favour of funding, for example very strong prospects of success, the defendant indicating an intention to resolve the claim commercially, a looming trial or mediation and/or the IP and retained solicitors being willing to carry some of the risk by deferring some (or all) of their fees pending a favourable outcome.

Some recent examples in which IMF has provided small claim funding and preliminary funding to IPs:

- IMF provided funding to a liquidator to pursue negligence and misleading and deceptive conduct claims against the company’s former professional advisors whose advice allegedly caused it to incur a debt to the ATO of approximately $1.2 million. IMF agreed to fund the claim on terms that it pay agreed costs of the solicitors and the IP plus Counsel and expert witness fees and full adverse costs protection.

- IMF provided funding to a trustee in bankruptcy to pursue preference claims worth $873,000. Funding covered 100% of the IP’s legal costs as well as full protection against any adverse costs orders. The claim was resolved for $500,000 within 6 months after entry into the LFA. The IP received $310,000 (62% of the Resolution Sum) after payment of legal costs and IMF’s fee (30%).

- IMF provided funding to a liquidator to pursue a preference claim for $600,000. Given the modest claim value funding was provided for an expert insolvency report and disbursements and 100% of adverse costs. The IP and the solicitors agreed to carry their fees payable upon successful claim resolution.

- IMF entered into a PFA with a liquidator by which IMF agreed to pay the costs of legal advice on prospects of an insolvent trading claim and for the IP to complete a preliminary insolvency report. In return IMF received a right of first refusal to fund the insolvent trading claim (subject to creditor approval) following receipt of the insolvency report and advice.

Our Investment Managers would be pleased to address any queries you may have about IMF’s funding products for IPs - please visit www.imf.com.au/contact for IMF’s nationwide contact details.

1 Since the NSW Court of Appeal’s judgment in Hall v Poolman [2009] NSWCA 64 consternation among IPs about pursuing meritorious claims absent a degree of certainty that recoveries will be sufficient to pay a dividend to creditors has dissipated. Recent decisions have continued the trend of authority that defendants cannot defeat an IP’s claim by pointing to a likely nil return to creditors, so long as the IP gives full and proper consideration to the claim before commencing proceedings (even if recoveries are likely to be limited to the IP’s and the funder’s fees). See also In the matter of Mustang Marine Australia Services Pty Ltd [2014] NSWSC 1074; Marsden v Screenmasters Australia Pty Ltd [2015] FCA 1256