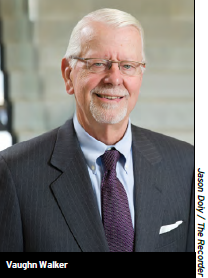

Bentham IMF Investment Committee Member Vaughn Walker Takes on Industry Critics and Advocates for the Benefits of Litigation Finance

Vaughn Walker, the retired Chief Judge of the U.S. District Court for the Northern District of California, and a member of Bentham's U.S. committee that considers and approves cases for funding, shared his views about litigation finance with ALM's Ben Hancock during a recent podcast. The wide-ranging conversation touches on Walker’s involvement with Bentham and his views on topics including the regulation, impact and future of the litigation finance industry.

"The litigation funding analysis is quite rigorous, so I'm not concerned that it is a process that is likely to drive spurious litigation," he says, refuting arguments the Chamber of Commerce has raised in opposition to litigation funding. "And I'm not even sure that it is likely to increase the magnitude of litigation. What it may very well do is to enable parties who have meritorious claims to prosecute those claims more effectively because they have the wherewithal to do so and to make settlement decisions based less upon immediate need than the actual prospects of the litigation itself. If anything, I think, by opening up an alternative source of capital for the litigation, it may actually improve the quality of litigation outcomes, rather than the other way around." As for the Chamber’s insistence on regulation of the industry, he notes, “Well it is ironic to have the Chamber of Commerce advocating regulation in this field where it advocates non-regulation in so many other fields."

Walker does, however, see logic in the argument that funder involvement in litigation should be disclosed under certain circumstances. “If a litigation funder does have a role in a settlement decision, it would be appropriate to identify that funder in connection with the disclosures that are required in the course of litigation," he says. "I suspect that some form of disclosure with respect to litigation funding will at some point or another be required. Exactly what form that will take and when it will occur, I'm not prepared to speculate about because I just don't know." Bentham has posited that disclosure is unnecessary when the funder has no control over the litigation outcome.

Walker notes he is impressed by Bentham’s concerns during its investment review process over how the litigation they potentially fund will have an impact on the public interest. Commenting on how funding could positively influence the legal industry he said, "A great many law firms essentially operate on an hourly basis. A lot of practice does not lend itself to the billable hour. And the availability of litigation financing may enable firms that have heretofore depended on the billable hour to engage in those other areas of practice. So it may very well increase the competitiveness of practice in certain areas, which could very well be a positive."

"Litigation is here to stay, there's no doubt about it,” he says later in the podcast. “And secondly, litigation requires capital. And how that capital is provided - and who the providers of the capital are - are really the questions that you're trying to answer."