Case Study: How Litigation Funding Increases Revenue, Preserves Capital and De-Risks Litigation

Litigation funding is gaining in popularity among plaintiffs, especially corporate litigants who could fund their own litigation but are looking at litigation funding as a form of project finance. This is because the business community and their legal advisors have begun to see litigation as a project or an asset class—one which they can unlock by using litigation funding.

How can a litigation funder help corporate litigants? It can do so by making litigation:

1. Less risky. Litigation funding can be used to pay legal fees and disbursements, and any adverse costs awards (if the litigation is unsuccessful), all on a non-recourse basis.

2. Less distracting. Litigation funding can allow the company to preserve its own capital for other purposes and to invest in its core business.

3. Less impactful on the balance sheet. Litigation funding can remove the need for the company to account for lawsuit-related costs and contingent liabilities.

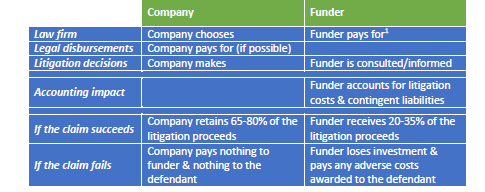

Each funding agreement is bespoke, individually designed to meet the litigant’s requirements. However, in general, a funder who assumes all of the cost and risk of the litigation typically asks for a return in the realm of 20-35% of any litigation proceeds, if the case is successful.

An example funding arrangement between a company and litigation funder might look like this:

Case Study

Acme Corp. is debating whether to pursue two valuable and equally meritorious claims, "Case #1" and "Case #2". Each of these has the potential to result in a $20M judgment.

Acme is generally reticent to bring any litigation—lawsuits can be risky, distracting and unwelcome on the balance sheet. However, Acme believes strongly in both cases and thinks they would be good investments. It also wants to be seen in the market as being willing and able to assert its legal rights in court.

The company’s legal department has a maximum annual budget of $5M. $2.5M has already been allocated to corporate legal matters and defence-side litigation. As a result, regardless of the strength and potential value of any plaintiff-side claims, absent an increase in its budget, the legal department has no more than $2.5M to pursue the two plaintiff-side claims.

The existing budget is not sufficient for Acme to pursue both Cases #1 and #2. Acme’s preferred law firm has prepared a budget that estimates it will cost Acme, for each case, $2M in legal fees plus $0.25M in disbursements. The firm has also estimated that, for each lawsuit it brings and loses, Acme could be exposed to another $0.75M in court-ordered adverse costs payable to the defendant.

In this situation, Acme’s legal department can recommend only one lawsuit. For simplicity, this scenario assumes it is Case #1.

How Can Litigation Funding Help?

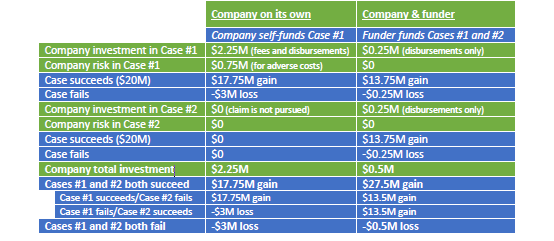

If both Cases #1 and #2 meet the litigation funder’s investment criteria, the funder can pay Acme’s $4M in total legal fees, allowing the company to use its preferred law firm to litigate both cases. Acme can contribute $0.5M for total disbursements. On success, Acme would pay 30% of proceeds to the funder. This arrangement frees up Acme’s own capital for investment in its business and protects Acme from any adverse costs awards: if the litigation fails, it is the funder who is liable to pay $1.5M in total adverse costs.

By using litigation funding to bring both cases, Acme is able to (1) diversify its risk, allowing it to yield a $13.5M return in the event either Case #1 or Case #2 succeeds, (2) increase its overall potential net gain from $17.75M to $27.5M, and (3) reduce its overall potential net loss from -$3M to -$0.5M:

Even if Acme could afford to invest the $4.5M in fees and disbursements to bring both Cases #1 and #2 on its own, it could still benefit from partnering with a litigation funder. If, for instance, both Cases failed, the company would generate a loss of only -$0.5M rather than -$6M.

Learn more

To learn more about how litigation funding can benefit companies, and to discuss any specific questions or situations, please contact Bentham’s team at 416-583-5720 or https://www.benthamimf.ca/. We are a team of former litigators from top Canadian firms ready to help you in any way we can.

1. In many cases, the company’s law firm agrees to invest in the litigation by reducing its legal fees, thus sharing some of the litigation risks with the funder. In exchange, the firm typically receives some of the funder’s portion of the litigation proceeds, if the case succeeds. Such a risk-sharing arrangement can signal to the client that its lawyers believe in the merits of the litigation and are willing to invest in its success.